Focused on lightweight, robust and power-frugal devices with better performance that are easier to use, infantry night vision is evolving through refinements to existing technologies, while more revolutionary change seems to be hovering tantalisingly in the wings.

Among many promising developments, W. Eric Garris, night vision and soldier systems product manager and chief technologist for communications systems at Harris, picked out two: The first development is driven by a need for smaller, lighter direct-view systems, and the second is focused on better situational awareness. “Soldiers are wanting more utility from their night vision devices than just being able to see in the dark,” he told AMR, “specifically light-secure situational awareness in a head-up display in combination with (their) night vision.”

Digital imaging devices such as Complementary Metal Oxide Silicon (CMOS) imagers are beginning to encroach onto the territory of the inherently analogue image intensifier; a development that companies are keen to further because digital output signals lend themselves more easily to advanced functions such as distribution across digital communications networks and for image fusion. CMOS technology is used for chip construction and it offers both comparatively low power consumption and a high noise immunity meaning that the chip has a high resistance to interference.

CMOS limitations

However, Mr. Garris cautions that CMOS-enabled devices have compromised low-light performance and high latency, in terms of what soldiers need regarding the screen refresh rate, and use more power than the best image intensified devices. It is natural to expect digital devices to replace their analogue counterparts, but this could take longer than might be expected. “At the earliest would be on a five-to-ten-year horizon, as digital night vision sensors will require a leap in technology not currently on the market as well as associated technologies to address the related technology integration requirements.”

Benny Kokia, vice president for sales and marketing at Israeli night vision systems manufacturer Meprolight, pointed out that image intensifier makers are pushing the performance of their analogue tubes ever higher. This means that digital devices are chasing a moving target in terms of the main performance measure known as the Figure of Merit (FoM). This is derived by multiplying the resolution expressed as line-pairs per millimetre (lp/mm) by the Signal-to-Noise Ratio (SNR), and high-performance tubes now on offer have FoM numbers typically between 1800 and 2400, he said.

“I believe that the massive investments of tube manufacturers into the high-end tubes are a proper answer to the penetration of the CMOS technology,” added Mr. Kokia.

While the FoM is a recognised industry standard for measuring tube performance, the kind of numbers that means more to soldiers on the battlefield are Detection, Recognition and Identification (DRI) ranges. Here, Mr. Kokia argues, image intensifiers still have a significant advantage over digital alternatives such as CMOS. Where the former can achieve these goals at ranges between 150 metres/m (492.1 feet/ft) and 300m (984ft), the latter are limited to 50m (164ft) to 150m. This, he said, is acceptable for civilian applications such as hunting, but not for tactical applications. “If a company (could) provide a CMOS technology with a DRI that will reach 300m or 400m (1312ft) it will really be a threat, or at least good competition, to conventional, analogue Night Vision Goggle (NVG) technology, but I think we have to look very carefully at CMOS technology and that in two, three or four years from now it might be a suitable alternative.”

Smaller Intensifiers

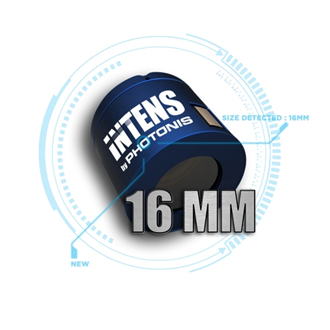

At the same time Mr. Kokia points out that image intensifiers are getting smaller; a move largely driven by Dutch company Photonis which is pitching 16 millimetre/mm diameter tubes into an area of the infantry market now dominated by 18mm tubes. “I believe that it will be hard for them to penetrate the 18mm market, although there are benefits to those that will adopt this technology,” Mr. Kokia continued, “ … because the 16mm tubes will help manufacturers to create lighter and smaller devices. I think that it is the early adopters that will accept this technology, but basically the mainstream market will continue to use 18mm tubes.”

Oded Ben David, Elbit Systems’ Elop division’s vice president for land electro-optics and thermal imaging, perceives stability in the infantry night vision market despite technological developments continuing in the background, but with a less rapid take-up of thermal sights than initially expected. “Everybody thought that everybody was going to go for thermal sights for every soldier.” That did not happen, he said, because costs have been too high, but nevertheless, Mr. Ben David argues that the situation will change with time. “Thermal weapon sights will become cheaper and cheaper, lower in weight and will grow in numbers. There is no question that they are needed. The only question here is volume; if you need large volumes it is a matter of the pricing point.”

This translates into sustained demand for image-intensified devices including goggles and monocular scopes and sights, he continued. Elbit’s latest product in this line is the XACT-NV32, a “micro-compact” night vision monocular intended to be mounted on a weapon, a helmet or worn on the head with appropriate adapters. Weighing less than 180 grams/g (0.3 pounds/lbs), it features a Photonis XD-4 tube and an integral laser illuminator offering a 40 degree field-of-view, 25mm eye relief and a focus range of 250mm to infinity, operating for more than 48 hours on a single 1.5 volt (V) AA or 3.6V lithium battery.

Fusion issues

With the possible exception of sensors used aboard mini- and micro-UAVs (Unmanned Aerial Vehicles), infantry optronic systems are the most demanding in terms of minimising Size, Weight and Power (SWAP), which makes the practical implementation of multi-sensor systems (where the output of several sensors is combined to build one image) a very tough nut to crack. The Harris Spiral Enhanced Night Vision Goggle (SENVG) is one of very few to achieve this, with an alternative thermal clip-on approach from companies such as Thermoteknix and Vectronix also proving attractive.

Mr. Garris picked Harris i-Aware Tactical Mobility Night Vision Goggle (TM NVG) with its integrated camera and communications link that provides a digital import/export capability as representing one of the most significant technological developments of recent years. He also cited the task of integrating two or more sensors into devices in a very rugged (non-clip-on) manner as one of the major challenges involved in creating fused image-intensified/thermal devices for infantry, particularly when seeking a long operational life with tight image fusion alignment.

Networked vision

He told AMR that there is military interest in these systems, but implied that the market is still in its early stages outside the United States. “They are looking again at the ability for a more complete system capability that links the fused night vision goggle with the network battlefield.” Mr. Kokia, meanwhile, sounded a note of caution regarding fusion, commenting that he has been hearing the term in the defence community for the last decade or so, but he does not regard much of what has been offered so far for infantry as true fusion. “There are systems that combine NVGs with uncooled thermal (imaging). However, if you look for a reliable system doing real fusion of thermal and NVGs, you will not find many players,” he said. “The challenge (is) to be able to create a very compact system that would also be versatile, that (can be used) on helmets and mounted on rifles.”

When customers approach Meprolight asking about fusion, he is hesitant, he said, telling them that the company is not in the fusion business because the return would probably not cover the investment and that currently available clip-on devices provide viable alternatives. “It will take a few more years for the industry, and also for the end users, to understand that if they are looking for fusion solutions they will have to pay a bit more, and when I say a bit more it is really a substantial amount, and it will take a few more years to introduce compact systems. I do not think that the industry is there yet.”

Discussions of fusion in this context usually concentrate on thermal imaging and image intensification, but this is a difficult combination to fuse, in part because of the latter’s analogue nature, but other combinations, Mr. Kokia argued, might produce results more quickly. CMOS could be one of these, he told AMR. “It is not very expensive, it will develop into a reliable technology, I believe in two or three years, and might give some answers to those that are looking for fusion. But when we are talking about thermal and NVGs, I am not very optimistic about this combination. I think that the market is not there; end users are not willing to pay the price.” However, he does believe that the need for snipers and sharpshooters and even soldiers in close-quarter battle to identify targets much more quickly might accelerate the development of fused systems.

Versatility vital

Mr. Kokia stressed the ongoing importance of versatility in this sector of the market, as embodied in the company’s new Minimon (L), a monocular device with an 18mm image intensifier tube that can be held in the hand, mounted on an assault rifle or worn attached to a helmet or other headgear such as a face mask. It provides a 40-degree field-of-view while maintaining full peripheral vision with the unaided eye and comes with an integral infrared LED (Light Emitting Diode) illuminator.

Developed in response to an Israeli tactical requirement, the combination of qualities desired for the Minimon (L) took considerable effort. “It took us a year of research and development to create a robust kind of a mini-monocular that can sustain the recoil of an assault rifle,” Mr. Kokia told AMR. “The challenge was to reduce the weight … because if you want to take it off the rifle and put it on your helmet, you cannot mount a system that weighs even 500g (1.1lbs) on a helmet.”

The company has not revealed the actual weight of the Minimon (L), instead describing it as “extremely lightweight”. This chimes with an on-going research and development effort at Meprolight to reduce the weight of its night vision devices through the application of new materials without sacrificing robustness. Again, this is driven by tactical requirements. “This kind of requirement presents quite a lot of challenges to us because, again, we need to keep it light, keep it durable, and we are trying all kinds of composite materials.”

Aide Memoire

In a conservative market, thoughtful refinements to established products are likely to be more successful than the pursuit of revolutionary change. One of Meprolight’s latest is a modification to the Hunter sniper sight that enables it to hold in memory all the elevation and windage click adjustments that the shooter makes, which emerged from a study the company conducted in cooperation with Israel’s Yamam special police unit. Having to remember every click away from the sight’s original zero adds to the sniper’s work load in high-pressure situations and can mean a critical loss of time to hit the target, which may be exposed only very briefly, Mr. Kokia argued. Meprolight made this modification available in December 2015. Mr. Kokia also reports demand for black and white night vision devices that use a white rather than a green phosphor screen in the image intensifier tube, a trend that Mr. Garris also noted and believes is likely to gain ground. “White phosphor is going to be adopted to a much larger degree than just a niche,” Mr. Garris. “Albeit with no lab-specific information to back it up, users are requesting white phosphor in larger numbers, primarily within the special operations community.” Due to the lower volumes demanded, tubes using white phosphor are more expensive today, he said, adding that, in the longer term, a shift to white from green could bring the two technologies’ prices closer together, although white phosphor is still likely to command a premium.

For Mr. Garris, the most important developments to come in the next few years will centre on what he called the refined integration of network-enabled NVGs as a deployment-ready capability, with the main focus on the ability to access imagery from the solider on the battlefield by night and day. While sensor fusion is a reality in applications with less severe SWAP constraints and promising steps towards it have been made in the lightest infantry equipment, true fusion might ultimately depend on a major technological breakthrough, such as a single detector chip sensitive to all the useful infrared wavelengths as well as visible light.